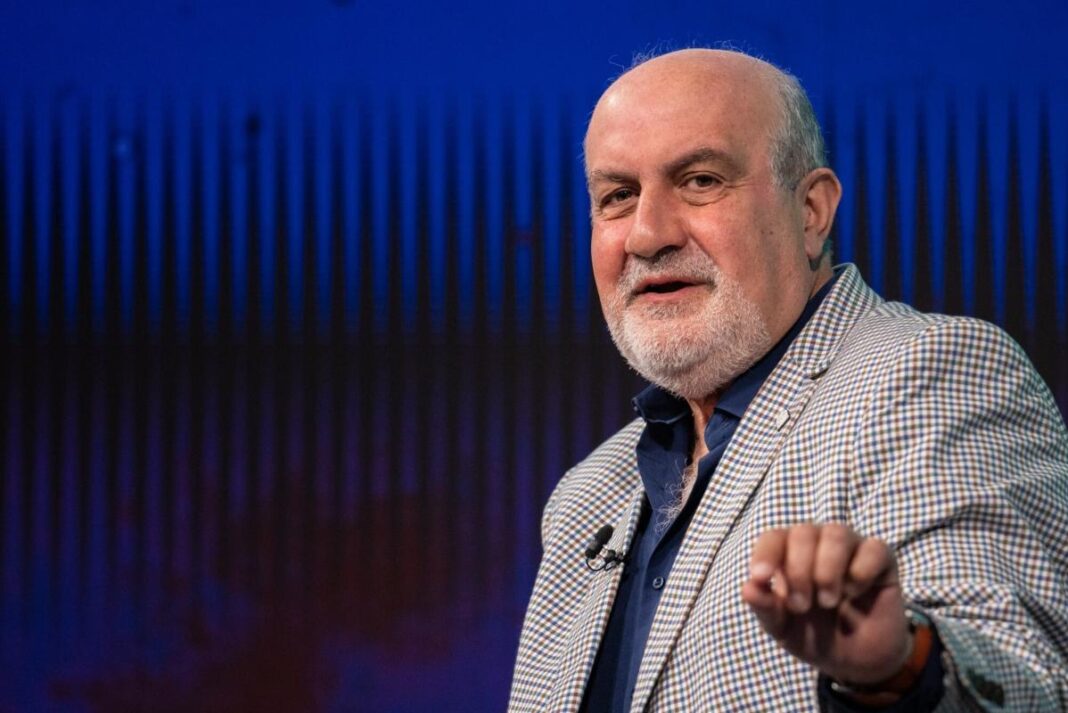

(Bloomberg) — The Black Swan author Nassim Taleb is warning that Monday’s brutal selloff in Nvidia Corp. is just a taste of what’s in store for investors who blindly piled into Wall Street’s AI-driven stock rally.

Most Read from Bloomberg

Future pullbacks could be two- or even three-times bigger than the 17% slump posted by Nvidia at the start of this week, Taleb said on the sidelines of what’s become known as Hedge Fund Week in Miami. That drop wiped $589 billion from the chip maker’s valuation, making it the worst in market history.

“This is the beginning,” Taleb told Bloomberg News in an interview after the close of markets on Monday. “The beginning of an adjustment of people to reality. Because now they realize, now, it’s no longer flawless. You have a small little chip on the glass.”

The frenzied selling was triggered by sudden fears that US tech giants may not dominate the field of artificial intelligence as expected. The concerns follow the emergence of DeepSeek, a Chinese AI startup that has demonstrated a lower-cost approach to developing the technology.

Investors interpreted that as a threat to both demand for and reliance on Nvidia’s advanced chips. Taleb said investors have until now been too focused on a single narrative: That the company’s shares would keep rising as it maintains its dominance of AI. Monday’s retreat was actually “very little” considering the risks in the industry, he said.

Crash Protection

Taleb, whose best-selling book explores the extreme impacts of rare and unpredictable occurrences, is also scientific adviser to Universa Investments. That’s a tail-risk hedge fund, which effectively offers a form of insurance to help protect portfolios from violent market events.

The former options trader is well-known on Wall Street for his gloomy pronouncements, not all of which have proved accurate. In early 2023, he said many investors were ill-prepared for the era of higher interest rates when assets may no longer be “inflating like crazy.” The benchmark US equity gauge is up almost 50% since, in large part because of the frenzy for all things AI.

Taleb and Universa’s argument is not that investors should run from the market, and hence miss such gains. Rather, they advocate allocating a sliver of portfolios toward protection from unexpected shocks.